It is considered a universal good in driving better sustainability and financial performance within the finance sector. From a regulatory perspective, long-term financial stability is a core feature of the EU Renewed Sustainable Finance strategy and more long-term assets enjoy preferential tax treatments in the United Kingdom. But what really is a long-term investor?

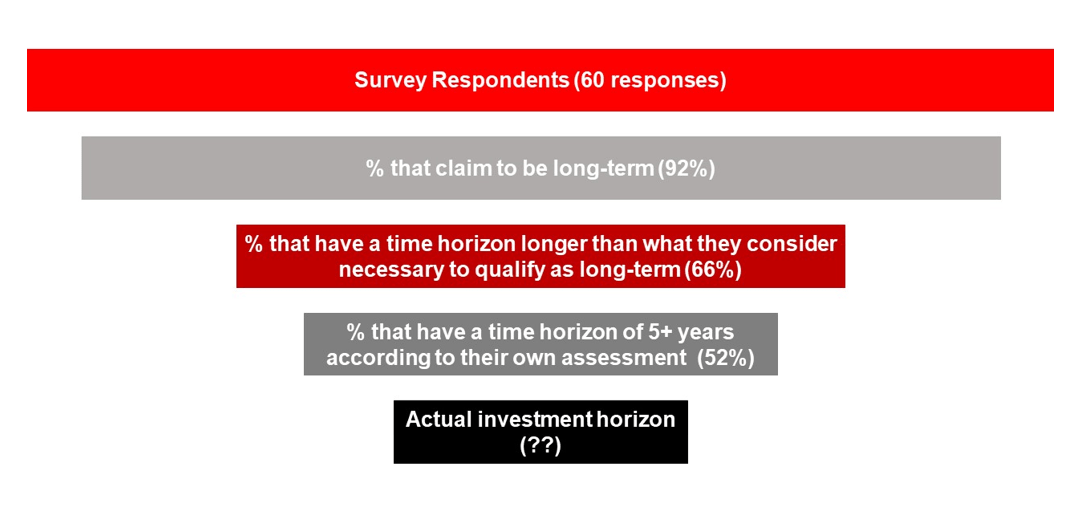

To address this seemingly simple question, Sustainable Finance Observatory’s (formerly 2DII) long-term risk research program, 1in1000, conducted 60 in-depth interviews with asset managers and asset owners. We sought to find out how they define the term, the extent to which they see value in long-termism for financial and sustainability performance, and the mechanisms to orient financial markets towards the long-term.

Our 3 key takeaways from the interviews:

- Everyone thinks being a long-term investor is a “good thing.”

- Asset managers and asset owners think they’re long-term investors, but they don’t agree with each other on what that means.

- Ironically, most investors are not long-term investors, according to their own definitions.

Below: The cascade effect of survey respondents to actual investment horizon

This means that despite the societal consensus around the benefits of being a long-term investor, there’s no consensus over what it means in practice. Critically, this confusion results in little to no accountability, regulation, or control as to the criteria that need to be met to qualify as a long-term investor.

In response, Sustainable Finance Observatory (formerly 2DII) recommends 3 key steps to improve financial sector long-termism to ensure both financial and societal returns:

- A common definition and criteria a financial institution must meet to qualify as a long-term investor

- A regulatory standard around the term to protect it and set incentives to drive long-termism forward

- Development of incentives linked to long-term criteria that relate to driving financial and societal outcomes

About our funders: This project is part of the International Climate Initiative (IKI). The Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU) supports this initiative on the basis of a decision adopted by the German Bundestag. This report also received funding from EIT Climate-KIC. This report reflects the authors’ views only, and the funders are not responsible for any use that may be made of the information it contains.

Why might your savings be funding fossil fuels?

Why might your savings be funding fossil fuels?