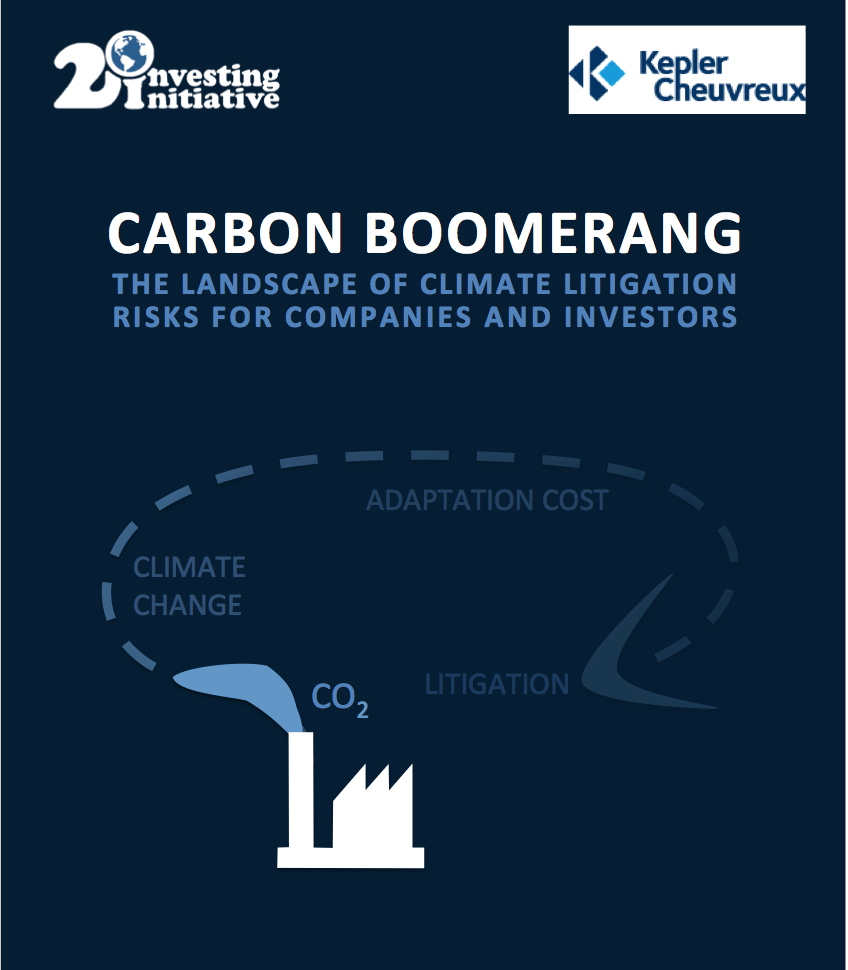

It is not limited to direct emissions and likely to occur in countries where extra- territorial jurisdiction and class action lawsuits exist. The tort cost could include adaptation costs at local level for states and cities (invested by anticipation), thus shortening the time horizon of risk from the years 2050-2100 to today. This concept note focuses on this type of risk.