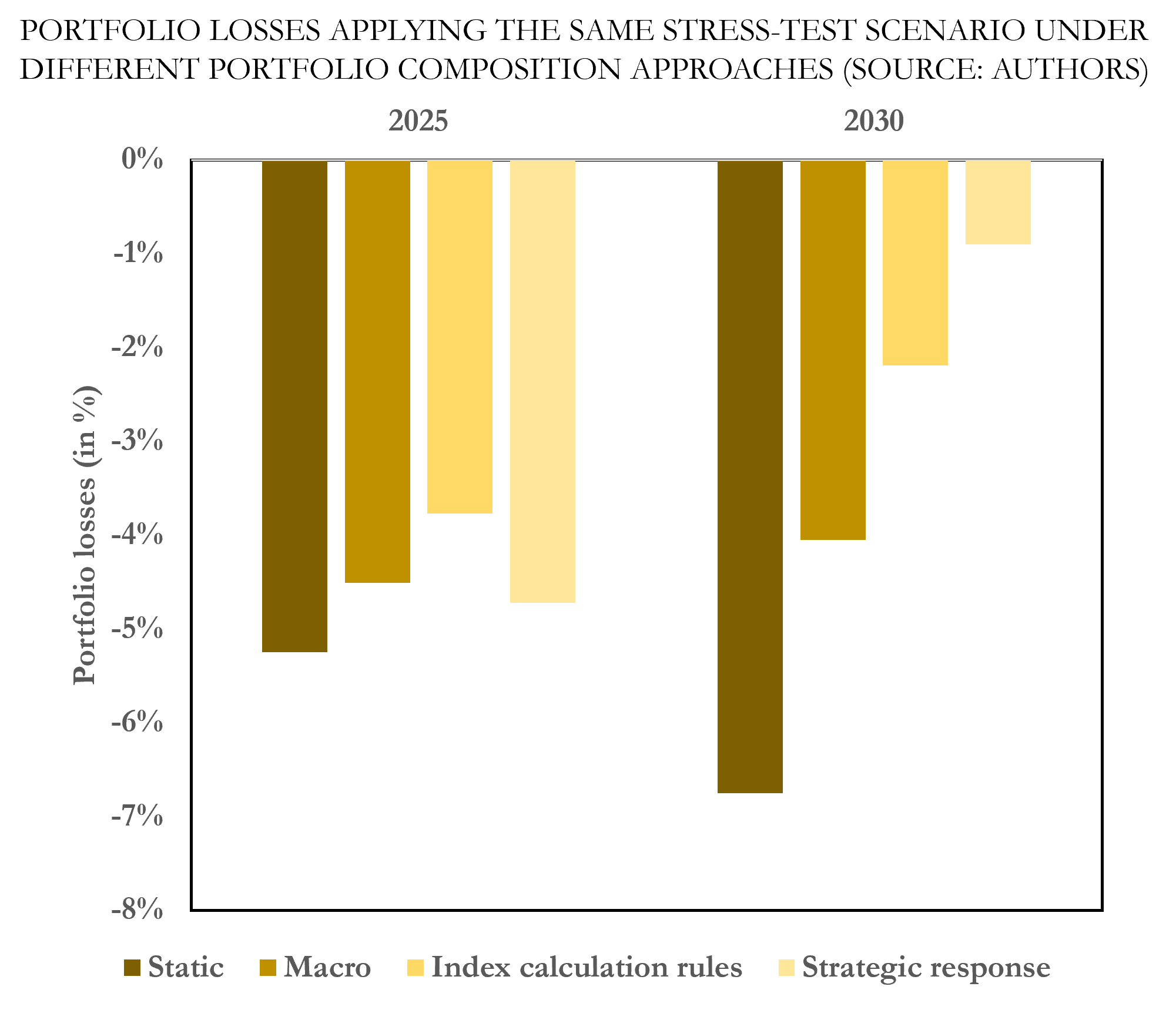

Addressing the question of whether portfolios should be ‘static’ or ‘dynamic’ in the context of long-term stress-tests and scenario analysis is a key question for the NGFS members and financial institutions. To date, there is limited research on the options and implications of how to address this issue. The 1in1000 programme is releasing a new report that explores 4 different avenues to adjusting assumptions around portfolio exposures, their pros and cons, and the potential impacts of dynamic portfolios on the results of stress-tests using a sample portfolio.

Funding: