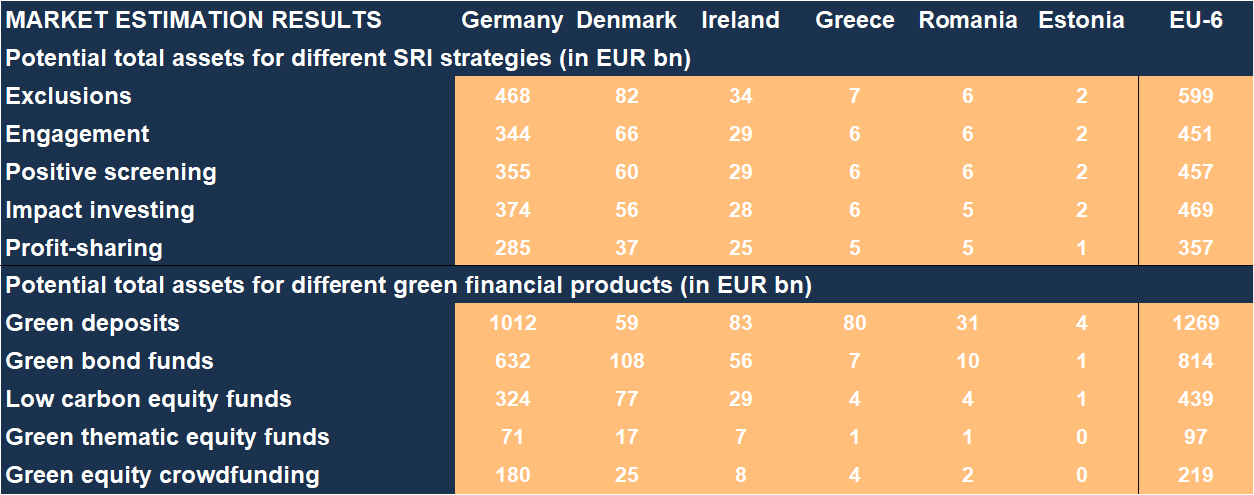

- We estimate the market potential for green financial retail products for Denmark, Estonia, Germany, Greece, Ireland, and Romania to be over 2.8 trillion EUR

- In contrast, the whole European market for green retail fund products was around 220 billion EUR in early 2021, illustrating the magnitude of the gap between offer and demand for green financial retail products

The market potential of various sustainable retail products is far from being exhausted. Based on our latest research on retail investor preferences, we estimate that there is a potential multi-trillion market opportunity for green financial products in Europe which remains unexploited by industry.

Put simply, the supply does not match the demand. The financial industry must experiment with new ways to serve the diversity of client profiles instead of offering one-size-fits-all products. Compared with exclusion funds, green bond funds, or green thematic funds, some products with currently low market shares (like impact investing, green saving accounts, or income-sharing funds) have yet to be proposed at a wider scale.

Even if the overall potential seems massive, several blockers could slow the pace of adoption of sustainable products in the future. For instance, households could suffer from behavioral inertia fueled by the high transaction costs associated with information overload or choice overload. There could consequently be a significant intention-behavior gap, leaving portfolio choices lagging responses in surveys.

Another blocker could arise due to mistrust towards financial institutions and sustainable finance due to greenwashing practices and scandals. In our survey, several counterintuitive results from Germany and Denmark point in that direction. But more qualitative data is needed to validate that interpretation.

Our market estimations were based on 6,000 surveys on retail investor preferences we carried out in Denmark, Estonia, Germany, Greece, Ireland, and Romania in late 2021 and financial market figures.

About our funders: This project has received funding from EIT Climate-KIC. The project is co-funded by the European Climate Initiative (EUKI) of the German Federal Ministry for Economic Affairs and Climate Action (BMWK). Disclaimer: This work reflects only the authors’ views, and the funders are not responsible for any use that may be made of the information it contains.