Find out the webinar replay of the IPAF presentation by Mickaël Mangot, Chief Scientific Officer “Retail and Impact Investing”, available here.*

*Do not forget to log in to Vimeo so you can see the video.

Sustainable Finance Observatory (formerly 2DII) is presenting a new science-based framework to assess the impact potential of financial products:

- The Impact Potential Assessment Framework (IPAF) assesses financial products based only on their actions to generate real-life impact,

- Using this methodology, the framework differs from other frameworks that choose to include in their ratings other sustainability/impact dimensions,

- It is exclusively based on public information provided by the product manufacturers,

- It is applicable to various types of financial products (funds in public markets, funds in private markets, deposits, crowdfunding investments) and sustainability objectives (e.g., climate, biodiversity, social issues, etc.).

The IPAF, as a multi-purpose framework:

- The IPAF has been designed to be used by impact-motivated retail investors to discriminate financial products based on their potential to deliver impact (per additional euro invested),

- The framework also provides avenues to product manufacturers to muscle up their impact actions and improve their impact communication (“do more and communicate better”),

- It finally serves as a tool against impact-washing by displaying practical limitations of self-labelled “impact products”.

A two-step methodology:

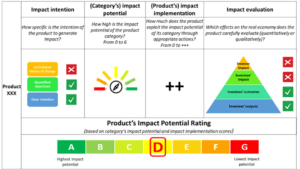

- The IPAF successively assesses two dimensions of the impact potential of financial products,

- First, it assesses the (maximum) impact potential of financial products based on impact mechanisms they supposedly apply (in relation to communicated elements in marketing documents). Those impact mechanisms are the ones widely documented by academic research:

- Grow new/undersupplied markets,

- Provide flexible capital,

- Engage actively,

- Send (market and nonmarket) signals.

- Second, it evaluates the implementation of that impact potential based on the intensity with which financial products action the various impact mechanisms in connection to success factors documented by academic research.

An aggregate score/rating as a synthesis:

- At the end of the scoring process, the IPAF delivers an Impact Potential Score which is the product of the two intermediary scores:

Impact Potential Score = Category’s Impact Potential Score * Product’s Implementation Score

- The Impact Potential Score is transformed into an Impact Potential Rating that goes from A (products with highest impact potential) to G (products with lowest impact potential).

A comprehensive factsheet that synthesizes information, including additional pieces that do not participate to the rating:

- Beside intermediary and final scores, the factsheet also displays impact intention details (i.e., how precise is the intention of the financial product to generate impact?)

- … as well as impact evaluation details (i.e., what kind of real-life outcomes does the financial product carefully evaluate?)

Discover also the 6 additional discussion papers:

- undersupplied markets

- flexible capital

- engage and vote

- non-financial support

- market signaling

- non-market signaling

About our funder and the project: This project is funded by the EU’s Horizon 2020 research and innovation program under Grant Agreement No 834345. LEVEL EEI aims at making the financial products contributing to energy efficiency and sustainable energy more competitive. This work reflects only the author’s view and the funder is not responsible for any use that may be made of the information it contains.

The paper is part of the Retail Investing Research Program at Sustainable Finance Observatory (formerly 2DII) which is one of the largest publicly funded research projects about the supply, demand, distribution and policy side of the retail investment market in Europe.