COP26 marks a milestone in assessing progress against the Paris Agreement objective to align financial flows with climate goals, enshrined under Article 2.1c. At the time of the Paris Agreement in 2015, tools to track progress towards this objective were still lacking. In response to this challenge, the Swiss and Dutch governments initiated an international governmental effort to prioritize tracking of financial sector alignment with climate goals.

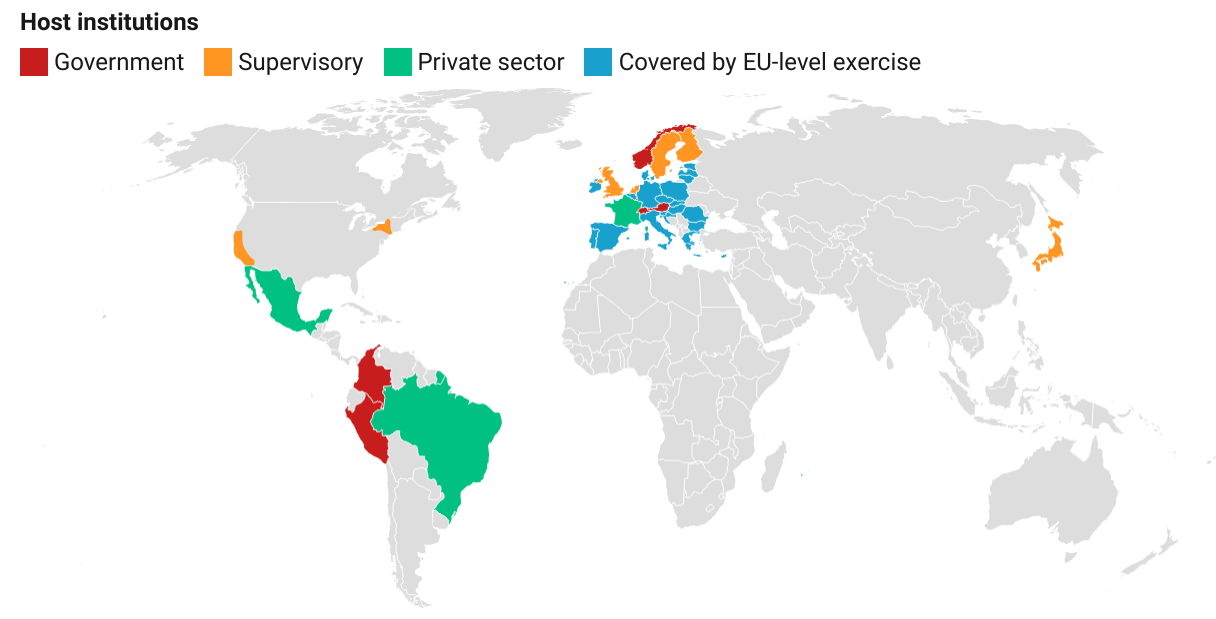

Now, marking COP26 Finance Day,Sustainable Finance Observatory (formerly 2DII) has launched a new stocktake of progress on these goals, with nationally coordinated assessments spanning four continents and nearly all major financial centers.

More on the stocktake

The report details the breakthrough of fully comparable assessments, coordinated by governments, financial supervisors, as well as private sector associations. It projects that the number of countries conducting such exercises will quadruple to 60 by 2025. As more countries repeat these assessments, this will also enable more meaningful progress-tracking and understanding of the real-world impact of financial markets.

Sustainable Finance Observatory (formerly 2DII) has been a key partner in these projects, working across all 16 countries to apply the Paris Agreement Capital Transition Assessment (PACTA) methodology. PACTA is the first portfolio alignment methodology developed in the world and remains available to all as an open-source, IP rights-free tool. Learn more and try it out on TransitionMonitor.com.

Jakob Thomä, Executive Director of Sustainable Finance Observatory (formerly 2DII), said, “The rise of nationally coordinated alignment assessments has changed the game in terms of tracking Article 2.1c progress. They enable countries to conduct a financial sector stocktake of their progress against climate goals, while allowing participating financial institutions to meaningfully benchmark themselves against their peers. It has been a privilege for Sustainable Finance Observatory (formerly 2DII) to support these exercises in partnership with leading governments, supervisors and industry associations.”

Dr. Franz Perrez, Ambassador for the Environment, Switzerland and H.R.H. Prince Jaime Bourbon de Parme, Climate Envoy of the Netherlands, said: “We welcome and are proud of the progress achieved to date, while recognizing that further steps are needed. Over the next 4 years, we hope to contribute to a broader coalition that expands this work around the globe. We are confident that countries will continue to assess the alignment of their national financial sector with climate goals on a regular basis so that we can collectively benchmark progress in the future in a meaningful way.”

About our funders: This report is part of a project that has received funding from the European Union’s Life NGO programme under grant agreement LIFE20 NGO/SGA/DE/200040. It has also received support from the Swiss Federal Office for Environment. Disclaimer: This work reflects only the authors’ view and the funders are not responsible for any use that may be made of the information it contains.