This report summarises research (quantitative survey, bilateral interviews, focus groups, mystery shopping and a desk-study of a fund database) conducted by Sustainable Finance Observatory (formerly 2DII) France to investigate the current situation regarding demand, supply and distribution of sustainable finance products in the French retail investment market.

The main results include:

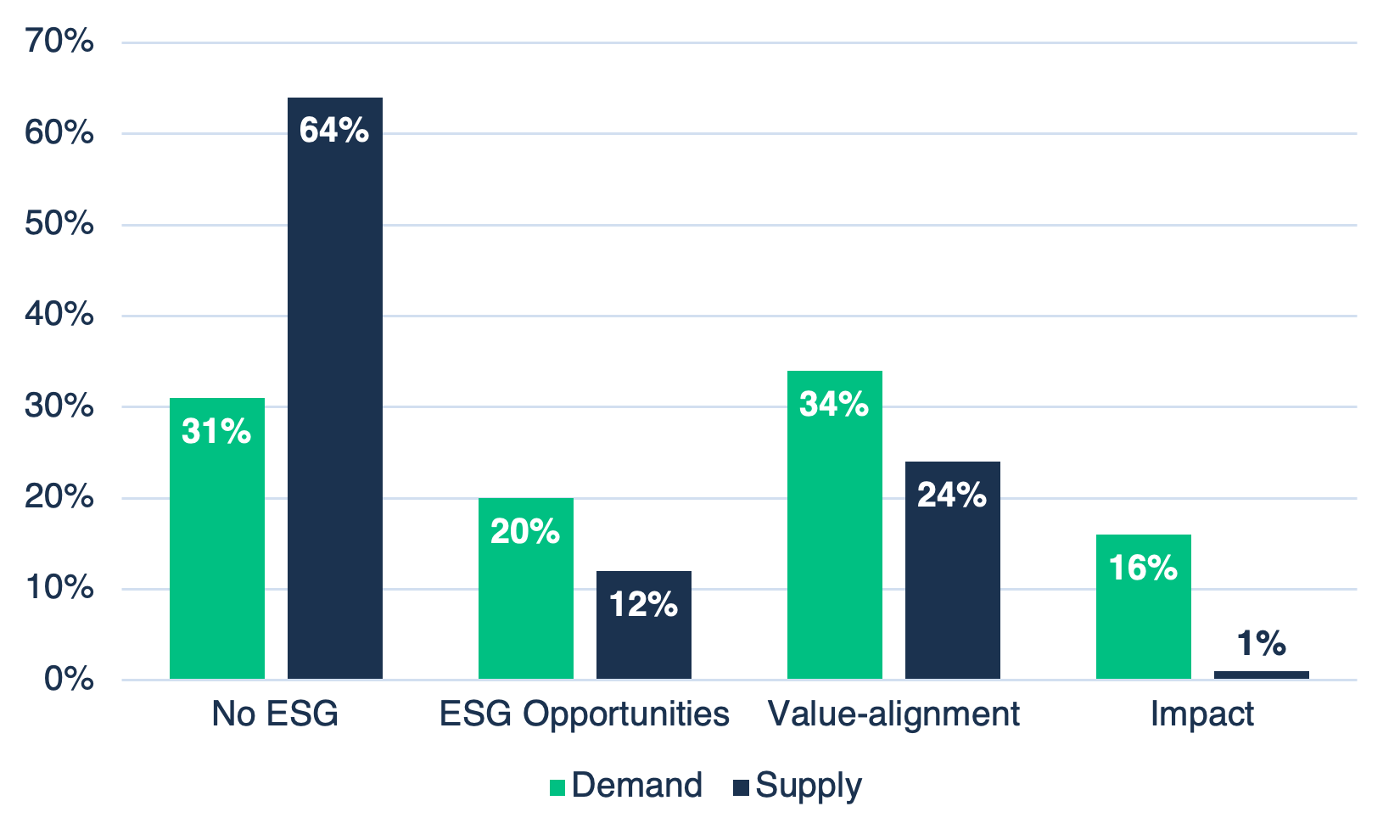

- On the demand side: a noticeable attitude-behaviour gap whereby positive attitudes of retail investors towards sustainable finance are not reflected in actual ownership of sustainable financial products. Across retail investors, beliefs and preferences regarding sustainable finance products are highly heterogeneous while (perceived) knowledge and trust is generally low.

- On the supply side: a highly concentrated offer, focusing on a few sustainable strategies and ESG topics. This concentration does not reflect the heterogeneity of client preferences regarding sustainable finance products observed on the demand side.

- On the distribution side: in the period before the new requirements to include a mandatory assessment of sustainability preferences in the suitability assessment, a tendency by financial advisors to apply an advisory process for potential clients that falls far short of these new requirements. Financial advisors were also frequently reported by clients and mystery shoppers to display a poor mastery of sustainable finance concepts and products.

Overall, the report reveals several critical areas of disfunction for the French retail market for sustainable financial products.

In particular, the comparison between demand (as expressed in our quantitative survey) and supply of sustainable funds available for French retail investors highlights a significant mismatch between client sustainability goals and what the market can offer. Our research enables us to distinguish three key sustainability goals which clients have when they want to invest sustainably: achieving impact, value alignment and/or maximising performance through ESG. But there are still far too many funds with no sustainability feature at all while there are too few funds suitable for retail investors who want to achieve impact in the world.

Figure: Mismatch between sustainability goals of supply and demand

Source: 2021 quantitative survey and Lipper database analysis

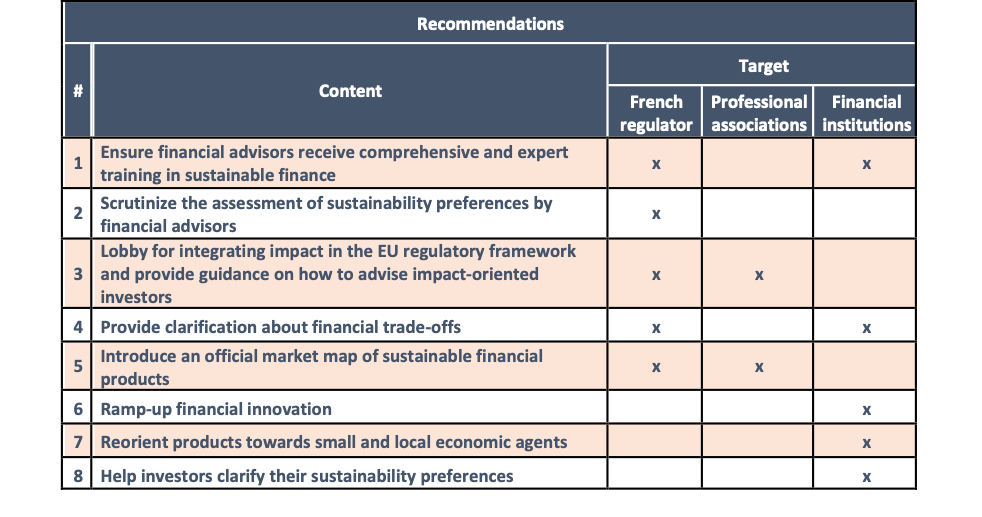

To address these disfunctions and promote integrity and efficiency in the French retail investment market, we articulate a list of targeted recommendations that are primarily directed at the French regulator, professional associations and financial institutions. The following table summarizes our recommendations.

Funder: This project has received funding from the European Union’s LIFE program under grant agreement LIFE18IPC/FR/000010 A.F.F.A.P.

Disclaimer: This work reflects only the views of Sustainable Finance Observatory (formerly 2DII). Other members of the Finance ClimAct Consortium and the European Commission are not responsible for any use that may be made of the information it contains.