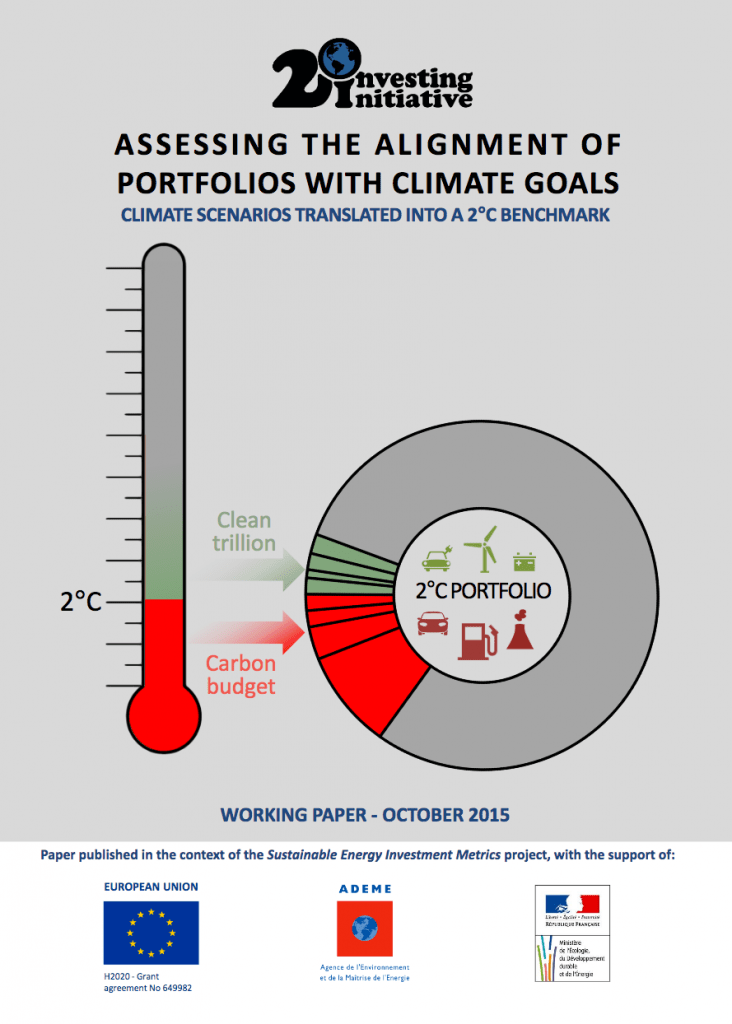

In performing this translation, the framework generates a set of key, sector-specific performance metrics that measure the exposure of a given portfolio to the energy and technologies that represent climate problems and solutions. These performance metrics allow for the first time portfolio-level benchmarking of climate policy alignment. They act as benchmarks for both asset managers and companies on how their business model today aligns with decarbonization trends and quantify the necessary steps to close the 2°C exposure gap.

The related presentation can be found here.