To participate in the webinar presentation led by Rob Bauer, Professor of Finance (Chair Institutional Investors) at Maastricht University School of Business and Economics, on October 13th, 2023, register here.

Most of this investment is not aligned with the sustainability motivations and preferences of EU investors. Currently, 60-70% of them repeatedly state that they actually want to sustainably invest their money. This gap between the current investment and the appetite of EU investors represents an untapped multi-trillion EUR opportunity for the European financial market.[2] Hence, those investment managers who truly understand the sustainability motivations and preferences of their investors and manage to integrate them into their product offerings will have a significant competitive advantage compared to their peers. However, to close the unsatisfied market demand, new expertise and tools are needed to successfully integrate investors’ preferences into the development and management of new product offerings.

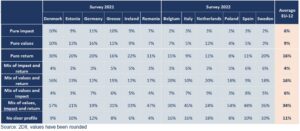

Distribution of sustainability profiles across Europe

For this reason, Sustainable Finance Observatory (formerly 2DII) and Maastricht University developed a practitioner guide for asset managers & asset owners to assess clients’ and beneficiaries’ sustainability preferences. We discuss five real cases in which the research team (including Paul Smeets (Universiteit van Amsterdam), Katrin Gödker (Bocconi), Marco Ceccarelli (Vrije Universiteit Amsterdam) around Prof. Rob Bauer (Chair Institutional Investors at Maastricht University) developed and applied surveys and experiments in different institutional contexts. For each case, we provide a table with a summary of the key background information and context, as well as a link to the surveys and elicitation methods. These methods are a function of the product, the legal context, and the financial institution’s context. The primary goal of the surveys and experiments were to improve the quality of the method to elicit the sustainability preferences from the beneficiaries of various contexts of pension plan arrangements and clients of mutual funds. The case studies included the following organisations:

- Pensioenfonds Detailhandel: A large Dutch pension plan (around 30 billion EUR of assets under management (AUM)) that provides a defined benefit (DB) pension plan to close to one million Dutch beneficiaries in the retail sector.

- Nationale Nederlanden: An international financial services company with a strong presence in many European countries and Japan (around 140 billion EUR of AUM). The experiment focused on an occupational pension solution (collective defined contribution (DC) pension plan) for small Dutch companies.

- BeFrank: A financial services company and part of the NN Group (around 7 billion EUR of AUM). The experiment focused on an occupational pension solution (collective defined contribution (DC) pension plan) for larger companies.

- Universities Superannuation Scheme (USS): The largest private pension plan (hybrid defined benefit (DB) and contribution (DC) in the UK (around 100 billion EUR AUM) and is primarily used by universities and higher education institutions.

- Meesman Indexbeleggen: A boutique mutual fund that provides Dutch retail investors with an umbrella of index investment vehicles in both equity and fixed income markets index mutual fund (around 1 billion EUR of AUM.

The findings show that the high-quality governance of survey and experiments is absolutely key. There are many concerns about ethics, GDPR, and wrong incentives (and more) for financial institutions. They also show that we need to further develop elicitation methods in both the domain of surveys and experiments and related and in other domains from different sciences (e.g. political science).

About our funder and the project: This project is funded by the EU’s Horizon 2020 research and innovation program under Grant Agreement No 834345. LEVEL EEI aims at making the financial products contributing to energy efficiency and sustainable energy more competitive. This work reflects only the author’s view and the funder is not responsible for any use that may be made of the information it contains.

The paper is part of the Retail Investing Research Program at Sustainable Finance Observatory (formerly 2DII) which is one of the largest publicly funded research projects about the supply, demand, distribution and policy side of the sustainable retail investment market in Europe.

[1] See Eurostat (2022), Households – statistics on financial assets and liabilities

[2] 2° Investing Initiative (2022), “What do your clients actually want? Understanding and estimating household demand for sustainable financial products” ; 2° Investing Initiative (2023), “6 National Country Reports”